There are many reasons for economic inequality within societies.

These causes are often inter-related. Acknowledged factors that impact economic inequality include:

- greater inequality in wages and salaries

- highly skilled workers earn more than low-skilled/no skills

- wealth condensation

- labour markets

- globalisation

- technological changes

- policy reforms

- taxes

- education

- computerization/growing technology

- gender

The labour market

A major cause of economic inequality within modern market economies is the determination of wages by the market. Inequality is caused by the differences in the supply and demand for different types of work. In a purely capitalist mode of production (i.e. where professional and labor organizations cannot limit the number of workers) the workers wages will not be controlled by these organizations, nor by the employer, but rather by the market. Wages work in the same way as prices for any other good. Thus, wages can be considered as a function of market price of skill. And therefore, inequality is driven by this price. Under the law of supply and demand, the price of skill is determined by a race between the demand for the skilled worker and the supply of the skilled worker. We would expect the price to rise when demand exceeds supply, and vice versa. Employers who offer a below market wage will find that their business is chronically understaffed. Their competitors will take advantage of the situation by offering a higher wage to snatch up the best of their labor. For a businessman who has the profit motive as the prime interest, it is a losing proposition to offer below or above market wages to workers.

A job where there are many workers willing to work a large amount of time (high supply) competing for a job that few require (low demand) will result in a low wage for that job. This is because competition between workers drives down the wage. An example of this would be jobs such as dish-washing or customer service. Competition amongst workers tends to drive down wages due to the expendable nature of the worker in relation to his or her particular job. A job where there are few able or willing workers (low supply), but a large need for the positions (high demand), will result in high wages for that job. This is because competition between employers for employees will drive up the wage. Examples of this would include jobs that require highly developed skills, rare abilities, or a high level of risk. Competition amongst employers tends to drive up wages due to the nature of the job, since there is a relative shortage of workers for the particular position. Professional and labor organizations may limit the supply of workers which results in higher demand and greater incomes for members. Members may also receive higher wages through collective bargaining, political influence, or corruption.

These supply and demand interactions result in a gradation of wage levels within society that significantly influence economic inequality.

Innate ability

Many people believe that differences in ability, such as intelligence, motivation, strength, or charisma, are largely innate and play a significant role in determining an individual's wealth. Individuals with higher ability are in greater demand increasing the wage of those who have them. Individuals with high abilities might also operate more effectively within society in general, regardless of the labor market.

Various studies have been conducted on the correlation between IQ scores and wealth or income. The book IQ and the Wealth of Nations, written by Dr. Richard Lynn, examines this relationship constructing a correlation of 0.82 between average IQ and GDP. Peer-reviewed research papers on the relationship have been criticised harshly. In his book The Mismeasure of Man, Stephen Jay Gould criticized intelligence testing, claiming that the tests and the statistical models used to evaluate them are inherently flawed. There is also the highly contested study The Bell Curve, which provides analysis that intelligence is substantially influenced by both genetics and environment and plays an increasing role in social stratification.

Taxes

Another cause is the rate at which income is taxed coupled with the progressivity of the tax system. A progressive tax is a tax by which the tax rate increases as the taxable base amount increases.

In a progressive tax system, the level of the top tax rate will have a direct impact on the level of inequality within a society, either increasing it or decreasing it. Additionally, a steeper progressivity results in an even more equal distribution of income across the board. The difference between the Gini index for an income distribution before taxation and the Gini index after taxation is an indicator for the effects of such taxation. Overall income tax rates in the United States are below the OECD average

There is debate between politicians and economists over the role of tax policy in mitigating or exacerbating wealth inequality. Economists such as Paul Krugman, Peter Orszag, and Emmanuel Saez have argued that tax policy in the post World War II era has indeed increased income inequality by enabling the wealthiest American workers far greater access to capital than lower-income Americans. Other economists and politicians, such as Paul Ryan, do not believe tax policy has created a chasm of wealth between the wealthy, middle, and lower class Americans.

Computerization/Innovative Technology

Another factor that contributed to the already growing inequality in the 20th century was computerization and growth in technology with electricity replacing manpower. With this growing change in technology, the United States experienced increasing demand for skilled workers to use computers and operate the electrical inventions. This resulted in a rightward shift in the Demand for Skilled Labor Supply, and this created an increase in the relative wages of the skilled compared to the wages of the unskilled workers. Such a change in wages added to the inequality that was already present.

Martin Ford, author of The Lights in the Tunnel: Automation, Accelerating Technology and the Economy of the Future,[30] argues that income inequality is likely to continue increasing as more jobs become susceptible to automation. As robotics and artificial intelligence develop further, even many skilled jobs may be threatened. Technologies such as machine learning may ultimately allow computers to do many knowledge-based jobs that require significant education. This may result in substantial unemployment at all skill levels, stagnant or falling wages for most workers, and increased concentration of income and wealth as the owners of capital capture an ever larger fraction of the economy. This in turn could lead to depressed consumer spending and economic growth as the bulk of the population lacks sufficient discretionary income to purchase the products and services produced by the economy; see Surplus value.

Education

One important factor in the creation of inequality is variation in individuals' access to education. Education, especially in an area where there is a high demand for workers, creates high wages for those with this education. As a result, those who are unable to afford an education, or choose not to pursue optional education, generally receive much lower wages. During the mass high school education movement from 1910–1940, there was an increase in skilled workers which led to a decrease in the price of skilled labor. High school education during the period was designed to equip students with necessary skill sets to be able to perform at work. In fact, it differs from the present high school education, which is regarded as a stepping stone to acquire college and advanced degrees. This decrease in wages caused a period of compression and decreased inequality between skilled and unskilled workers.

Economic neoliberalism

John Schmitt and Ben Zipperer (2006) of the CEPR point to economic liberalism and the reduction of business regulation along with the decline of union membership as one of the causes of economic inequality. In an analysis of the effects of intensive Anglo-American neoliberal policies in comparison to continental European neoliberalism, where unions have remained strong, they concluded "The U.S. economic and social model is associated with substantial levels of social exclusion, including high levels of income inequality, high relative and absolute poverty rates, poor and unequal educational outcomes, poor health outcomes, and high rates of crime and incarceration. At the same time, the available evidence provides little support for the view that U.S.-style labor-market flexibility dramatically improves labor-market outcomes. Despite popular prejudices to the contrary, the U.S. economy consistently affords a lower level of economic mobility than all the continental European countries for which data is available."

Globalization

Trade liberalization may shift economic inequality from a global to a domestic scale. When rich countries trade with poor countries, the low-skilled workers in the rich countries may see reduced wages as a result of the competition, while low-skilled workers in the poor countries may see increased wages. Trade economist Paul Krugman estimates that trade liberalisation has had a measurable effect on the rising inequality in the United States. He attributes this trend to increased trade with poor countries and the fragmentation of the means of production, resulting in low skilled jobs becoming more tradeable. However, he concedes that the effect of trade on inequality in America is minor when compared to other causes, such as technological innovation, a view shared by other experts. Lawrence Katz estimates that trade has only accounted for 5-15% of rising income inequality. Some economists, such as Robert Lawrence, dispute any such relationship. Lawrence, in particular, argues that technological innovation and automation has meant that low-skilled jobs have been replaced by machine labor in wealthier nations, and that wealthier countries no longer have significant numbers of low-skilled manufacturing workers that could be affected by competition from poor countries.

Gender, race, and culture

The existence of different genders, races and cultures within a society is also thought to contribute to economic inequality. Some psychologists such as Richard Lynn argue that there are innate group differences in ability that are partially responsible for producing race and gender group differences in wealth (see also race and intelligence, sex and intelligence) though this assertion is highly controversial. The concept of the gender gap also tries to explain differences in income between genders.

Culture and religion are thought to play a role in creating inequality by either encouraging or discouraging wealth-acquiring behavior, and by providing a basis for discrimination. In many countries individuals belonging to certain racial and ethnic minorities are more likely to be poor. Proposed causes include cultural differences amongst different races, an educational achievement gap, and racism.

Gender

In many countries, there is a gender income gap which favors males in the labor market. For example, the median full-time salary for U.S. women is 77% of that of U.S. men. Several factors other than discrimination may contribute to this gap. On average, women are more likely than men to consider factors other than pay when looking for work, and may be less willing to travel or relocate.

The U.S. Census's report on the wage gap reported "When we account for difference between male and female work patterns as well as other key factors, women earned, on average, 80 percent of what men earned in 2000… Even after accounting for key factors that affect earnings, our model could not explain all of the differences in earnings between men and women."

The income gap in other countries ranges from 53% in Botswana to -40% in Bahrain. In the United States, among women and men who never marry or have children, women make more than men. Additionally, women who work part-time make more on average than men who work part-time.

Gender inequality and discrimination is argued to cause and perpetuate poverty and vulnerability in society as a whole. Household and intra-household knowledge and resources are key influences in individuals' abilities to take advantage of external livelihood opportunities or respond appropriately to threats. High education levels and social integration significantly improve the productivity of all members of the household and improve equity throughout society. Gender Equity Indices seek to provide the tools to demonstrate this feature of poverty.

Diversity of preferences

Related to cultural issues, diversity of preferences within a society often contributes to economic inequality. When faced with the choice between working harder to earn more money or enjoying more leisure time, equally capable individuals with identical earning potential often choose different strategies. This leads to economic inequality even in societies with perfect equality in abilities and circumstances. The trade-off between work and leisure is particularly important in the supply side of the labor market in labor economics.

Likewise, individuals in a society often have different levels of risk aversion. When equally-able individuals undertake risky activities with the potential of large payoffs, such as starting new businesses, some ventures succeed and some fail. The presence of both successful and unsuccessful ventures in a society results in economic inequality even when all individuals are identical.

Development patterns

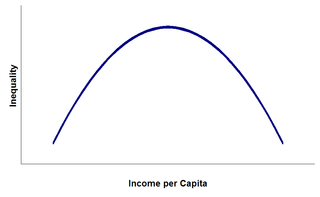

A Kuznets curve

Simon Kuznets argued that levels of economic inequality are in large part the result of stages of development. Kuznets saw a curve-like relationship between level of income and inequality, now known as Kuznets curve. According to Kuznets, countries with low levels of development have relatively equal distributions of wealth. As a country develops, it acquires more capital, which leads to the owners of this capital having more wealth and income and introducing inequality. Eventually, through various possible redistribution mechanisms such as social welfare programs, more developed countries move back to lower levels of inequality. Kuznets demonstrated this relationship using cross-sectional data. However, more recent testing of this theory with superior panel data has shown it to be very weak. Kuznets' curve predicts that income inequality will eventually decrease given time. As an example, income inequality did fall in the United States during its High School Movement in the 1940s and after. However, recent data shows that the level of income inequality began to rise after the 1970s. This does not necessarily disprove Kuznets' theory. It may be possible that another Kuznets' cycle is occurring, specifically the move from the manufacturing sector to the service sector. This implies that it may be possible for multiple Kuznets' cycles to be in effect at any given time.

Wealth concentration

Wealth concentration is a theoretical process by which, under certain conditions, newly-created wealth concentrates in the possession of already-wealthy individuals or entities. According to this theory, those who already hold wealth have the means to invest in new sources of creating wealth or to otherwise leverage the accumulation of wealth, thus are the beneficiaries of the new wealth. Over time, wealth condensation can significantly contribute to the persistence of inequality within society.

As an example of wealth concentration, truck drivers who own their own trucks often make more money than those who do not, since the owner of a truck can escape the rent charged to drivers by owners (even taking into account maintenance and other costs). Hence, a truck driver who has wealth to begin with can afford to buy his own truck in order to make more money. A truck driver who does not own his own truck makes a lesser wage and is therefore stuck in a Catch-22, unable to buy his own truck to increase his income.

As another example of wealth concentration, savings from the upper-income groups tend to accumulate much faster than saving from the lower-income groups. Upper-income groups can save a significant portion of their incomes. On the other hand, lower-income groups barely make enough to cover their consumptions, hence only capable of saving a fraction of their incomes or even none. Assuming both groups earn the same yield rate on their savings, the return on upper-income groups’ savings are much greater than the lower-income groups’ savings because upper-income groups have a much larger base.

Related to wealth concentration are the effects of intergenerational inequality and housing inequality. The rich tend to provide their offspring with a better education, increasing their chances of achieving a high income. Furthermore, the wealthy often leave their offspring with a hefty inheritance, jump-starting the process of wealth condensation for the next generation. However, it has been contended by some sociologists such as Charles Murray that this has little effect on one's long-term outcome and that innate ability is by far the best determinant of one's lifetime outcome.

In his 1985 book Regular Economic Cycles: Money, Inflation, Regulation and Depressions, Ravi Batra argues that a growing concentration of wealth, measured as the 'share of wealth held by the richest 1 percent', is linked to bank failures and depressions. In Table 1 on page 127, there is data for this measure for the years 1810-1969, showing a rise in this measure prior to the 1929 stock market crash.

"...as the concentration of wealth rises, the number of banks with relatively shaky loans also rises. And the higher the concentration, the greater is the number of potential bank failures."

Batra predicted the same would happen if the 1% share rose again.

Inflation

Some Austrian school economists have theorized that high inflation, caused by a country's monetary policy, can contribute to economic inequality.[42] This theory argues that inflation of the money supply is a coercive measure that favors those who already have an earning capacity, disfavoring those on fixed income or with savings, thus aggravating inequality. They cite examples of correlation between inflation and inequality and note that inflation can be caused independently by "printing money", suggesting causation of inequality by inflation.

Mobility

Entrenched strata of power -- whether economic, political, status, ascribed, or meritocratic -- can lead to decreased mobility by the assertion of that power, and lead to increased inequality.

Source:Wikipedia

No comments:

Post a Comment